Disclaimer: the best way to lower your taxes is to review your finances with a CPA tax professional. This article offers tips and information about capital gains tax only. Be sure to review your unique financial situation with your tax advisor to help avoid paying unnecessary taxes when selling your house while staying compliant.

Capital Gains Tax

Capital gains tax occurs when selling personal and investment real estate property if there is a gain on the sale. You are taxed on the profit you gain from the sale if you sold the item for more then you bought it for. The IRS form to file for capital gains is Schedule D.

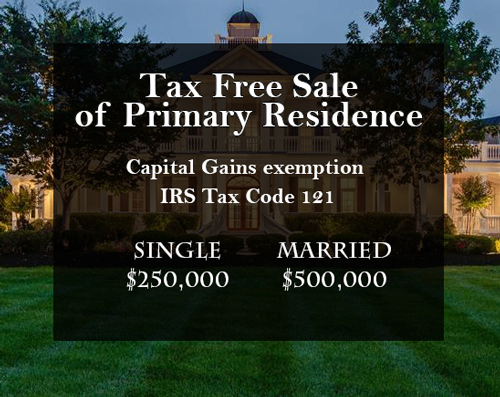

Your personal residence has an exemption to the capital gains tax under Section 121 of the tax code. If the following criteria are met you can exclude up to $500,000 of your gain if you are married filing jointly and up to $250,000 if you are filing single.

- The taxpayer must use the property as a principal residence for two out of the last five years prior to the sale.

- The use as a principal residence does not need to be in concurrent months.

- The §121 exclusion is only available once every two years.

- Second homes and vacation homes do not qualify for §121 tax exclusion.

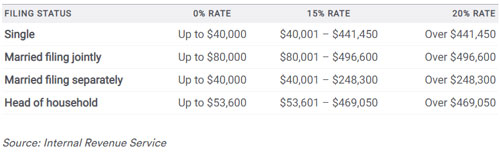

The amount you gain after these thresholds gets the capital gains tax applied. Here are the current long-term capital gain tax rates:

3 Tips on How to Reduce Capital Gains Tax Legally

#1 – Deduct Closing Costs

You are allowed to deduct all closing costs from the capital gain to help reduce the taxable balance. If, after you have applied your exemption amount and there still remains a capital gain be sure to also deduct all closing costs to further reduce your taxable capital gain amount.

Closing costs that you can deduct typically include the following;

Title Insurance, Escrow Fees, Commissions, Taxes, Recording Fees. Qualified closing costs include any fee that covers expenses needed to close the sale transaction.

#2 – Apply the exemption amount.

Subtract your exemption amount from the capital gain. Example #1 – A married couple sells their home for $1,300,000. They deduct the married filing jointly capital gains exemption of $500,000 from the capital gains amount. They also deduct what they originally paid for the property 10 years ago; $700,000. This brings their taxable amount to $100,000.

#3 – Deduct improvements that you invested in the home being sold.

Deduct major improvement items from the capital gain amount. The IRS defines the allowable improvement items as a home improvement that adds market value to the home, prolongs its useful life or adapts it to new uses. For example, improvements such as room additions, new decking, roof replacement, new HVAC, new wood flooring, kitchen remodel, bathroom remodel all qualify. Do not include minor repairs such as paint, lighting fixture replacement or other similar minor items.

Example – Bob and Mary from Example #1 remodeled their kitchen and their master bathroom 5 years ago. It cost them $80,000. They took their remaining capital gains amount of $100,000 and subtracted these major remodel costs. Their new capital gains taxable amount is $20,000.

Income Qualification

Another consideration for your CPA to work out with you is your income qualification. If your single income is $40,000 or less or your married income is $80,000 or less annually you are exempt from the capital gains tax. This income includes income after personal business expenses are deducted.

City and County Property Tax

It is important to have your real estate professional set up a prorated city and county tax sales agreement. This will ensure that the seller pays the city and county property taxes only up until the closing date and the buyer pays those taxes from the closing date moving forward.

The escrow company will be responsible for making sure those pro-rated amounts are calculated correctly for each party. Unfortunately there is no way of getting out of city and county property tax for either party unless the sales agreement stipulates that the buying party will pay all property taxes that are due. A purchase agreement can stipulate this as an added incentive to close the deal. In that case the buyer will pay for all property taxes that are currently due in addition to post closing.

Property Tax City Chart

2019 Property Tax Rates for Williamson County, TN

| AREA | CITY | COUNTY | TOTAL | |

|---|---|---|---|---|

| County Only | $0.00 | $2.22 | $2.22 | |

| Franklin Only (not in FSSD) | $.0.4176 | $2.16 | $2.5776 | |

| Franklin/FSSD | $0.4176 | $2.809 | SSD .8290 CO 1.98 |

$3.2266 |

| Ninth/Outside | $0.00 | $2.869 | SSD .8290 CO 2.04 |

$2.869 |

| Brentwood | $0.36 | $2.22 | $2.58 | |

| Fairview | $0.8765 | $2.22 | $3.0965 | |

| Nolensville | $.15 | $2.22 | $2.37 | |

| Spring Hill | $0.9169 | $2.16 | $3.0769 | |

| Thompson’s Station | $0.103 | $2.22 | $2.323 |

2021 Property Tax Rates for Davidson County, TN

| AREA | CITY | COUNTY | TOTAL | |

|---|---|---|---|---|

| County | $0.00 | $3.155 | $3.155 | |

| Urban Services District | $varies | $3.155 | $3.155 | |

| General Services District | $varies | $2.755 | $2.755 | |

Note: Rates are per $100.00 assessed property valuation

State Deed Tax

Tennessee imposes a recordation tax on all transfers of real property, with certain exceptions, for the privilege of having the instrument that evidences the transfer (e.g., deed, decree, etc.) recorded. The tax is based on the consideration for the transfer or the value of the property transferred, whichever is higher, and is 37 cents for every $100. The person who receives the property is responsible for paying the tax to the county register.

Tennessee also imposes a recordation tax on the recordation of any instrument of indebtedness (e.g., mortgage, deed of trust, lien on personal property (other than motor vehicles), etc.), with certain exceptions. This tax is 11.5 cents for every $100 of the indebtedness, but does not apply to the first $2,000 of the debt. The tax is paid by the debtor to the county register or the Tennessee Secretary of State.

For more information on Tennessee’s recordation taxes, see Tenn. Code Ann. § 67-4-409.

Sell House Tax

There’s no getting out of taxes when you’re buying or selling property. It comes along with the privilege of being able to be a property owner. Keep in mind that a lot of the tax goes to the city to help improve infrastructure and public services. It’s your contribution to the community.

Having said all of that, be smart and buy and sell real estate in a way that makes the most sense financially. Take advantage of these sell house tax deferrals when you can. Plan ahead to save money.