Here are the four steps to place your house into a trust. Before we move through the steps here is a short list of benefits of why you would want to put your home into a trust.

Benefits of setting up a trust;

- Protect Personal Assets

- Protect Privacy

- Control Distribution of Asset Income

- Control Asset Distribution

- Generate Non Personal Income

- Avoid Probate

- Reduce Estate Taxes

- Delay Taxes

1. Choose Type of Trust

Revocable Trust

This is a living trust that can be changed by the grantor at any time. You can include a stipulation that the Revocable Trust becomes Irrevocable at the time of the grantor’s death. This way, while the grantor is living changes can be made at any time up until the time of death at which time the current stipulations are set into an irrevocable arrangement.

Irrevocable Trust

This is a living trust that cannot be changed.

Living Trust

This is a trust that is set up while the grantor is alive.

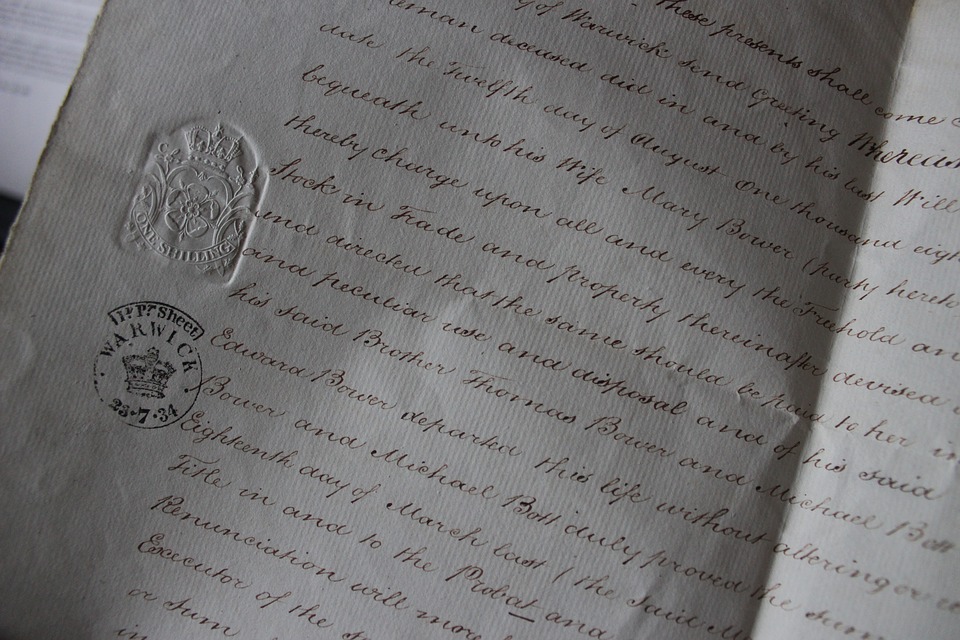

Testamentary Trust

This is a trust that is set up as a result of the grantor’s last will and testament.

2. Identify Roles

Grantor

The grantor is the person(s) who have assets titled to them and who will be transferring their title ownership into the trust.

Trustee

The trustee is the person who will be honoring, following and implementing the instructions of the trust. This person is legally responsible for carrying out what the trust agreement states regardless of personal interest. The Trust Agreement should also clarify how the trustee role will be handled when the primary trustee can or does not want to serve in that copacity. Be sure to identify who the secondary or co-trustee is and outline when the secondary would be activated.

If you are uncertain who the trustee should be, there are plenty of services that provide full corporate trustee management services that cover accounting, annual IRS filings and property management. Their fee is paid for from the operations of the asset management as would an individual trustee that the grantor designates. A benefit of hiring a corporate trustee is that the company providing the service does not expire. If you want to take this route but are getting resistance from your beneficiaries you can always include a clause in your trust agreement that states that if the beneficiaries are not satisfied with the corporate trustee then they can select a different company to take that role.

Beneficiaries

This is the person(s) who are identified in the trust agreement who are to receive either trust income or asset distribution or both.

3. Draft the Trust Agreement

The Trust Agreement contains the following;

- Name of the trust. Common names for trusts that include a residential property include a family name. For example, “The Hamilton Family Trust”.

- Identification and designations of the grantor, the trustee and the beneficiaries.

- Identification and verified title information, if any, for each asset that has been placed in the trust.

- Instructions for how each asset is to be managed. This includes detailed instructions for the management of the maintenance of the property, how income funds are to be used and timing and amount of distributions.

- Life of the trust. This should explain how long the trust is to remain active and under what circumstances it is to be terminated. Common law stipulated that a trust cannot last indefinitely. However, there are ways to navigate around this time restriction by setting up what’s called a “dynasty trust”.

The Trust Agreement should be drafted by an attorney. Expect to pay an attorney anywhere from $300 to $3,000 depending on the number of assets being placed and the complexity of management and distribution.

If you are using an online template or writing it yourself you will need to get it notarized with at least two witnesses at the very minimum.

4. Get a TIN – Optional

After the Trust Agreement is finalized you will need to decide if you want to register the trust entity with the IRS in order to obtain a Taxpayer Identification Number (TIN). If the grantor intends to retain the property until death under a revocable trust then the TIN number isn’t required until after death because the trust will be operating off of the grantors social security number for tax purposes. If it needs to be an irrevocable trust then a new TIN is required.

5. Open Bank Account – Optional

After you receive the TIN you will be able to open a separate bank account for the Trust.

The bank account will have the trust name and it’s TIN number. The trustee will be the signer on the account. If there is a secondary or co-trustee then that person should also be designated as a signer on the account.

The trustee will be responsible for keeping accounting records for seven years in case there is ever a lawsuit that involves the trust and for when the trustee is to hand over the operations management of the trust to the next trustee. The transfer of the trustee and it’s rules should be outlined in the Trust Agreement.

6. Fund the Trust

In order to have a valid trust, the trust must be funded by at least one asset.

The grantor(s) must execute a deed transfer of the property title into the trust. You do this by going to the county recorder of the deeds and sign over the title to the trust.

For example, if the current title’s owner name is “John Smith and Betty Smith”, you would transfer the title’s owner name to the trustee and the trust name. For example “Mike Smith Jr as Trustee for The Smith Family Trust”.

How to Obtain a Mortgage for Property in a Trust

Proceed with caution! If you are placing your home in a trust and need to obtain a mortgage to continue to finance the loan for the property you must proceed according to title change law. Your current mortgage lender that is financing your personal property mortgage can legally activate the due-on-sale clause anytime the interest in the property changes title without their prior written consent.

An inter vivo, or living trust, under the Garn-St. Germain Act of 1992 is a provision where lenders must allow transfer of title without calling a due-on-sale clause. This clause comes with requirements that must be followed in order to be allowed.

If the property currently has a mortgage and will still need to be funded by a mortgage then the trustee will need to refinance the loan.

The Trust Agreement will need to state that the trustees have the power to borrow money and pledge and encumber trust assets. The Trust Agreement with this stipulation will need to be reviewed by the bank. The bank will need to; verify the grantor and the trustee, review the newly revised deed and the Trust Agreement.

Mortgage of Trust Property Requirements

- Written notice to current personal mortgage lender of title transfer before placing property in trust.

- Borrower must be the property resident.

- Borrower must be the trustee or a beneficiary.

- Future transfer must give notice to lender prior.

- Future sale of property must give notice to lender prior.

FDIC regulations under the Garn-St. Germain Act require the borrower who wishes to place their home into a living trust to reside in the home. You must also consult the lender to arrange a way to notify them in a timely fashion if you plan to sell the house or otherwise transfer the title.

Other assets such as cash, vehicles and stocks can also be transferred into the trust. If an asset does not have a title document then you would list the item with a clear identifiable description.

The Trust should be a part of your overall Estate Plan that should include the following;

- Revocable or Irrevocable Trust

- Power of Attorney

- Living Will

- Healthcare Power of Attorney

Placing a property in a revocable trust provides protection of the property and if you determine to sell the property in the future it is not difficult.

How to Sell Trust Property

As the grantor, selling property that has been placed in a trust is different then selling a personally held property. When handled properly, here are some benefits;

- Capital Gains Tax Exclusion

- Avoid Probate

If you’re selling your primary residence, you are still subject to capital gains tax but can benefit from the exclusion. If you owned and lived in the home for at least two out of five years before the sale date, you may exclude up to $250,000 in capital gains if single and up to $500,000 if you are married and file jointly.

Obviously, a trust cannot “live” in a dwelling, but as noted, the IRS considers trust property as that of the grantor for tax purposes. In most cases, you can’t claim the exclusion again if you’ve sold a primary home and took advantage of the exclusion during the two-year period prior to the current sale.

You will need to confirm authority to sell the trust property by reviewing the Trust Agreement. It should state if the property may be sold or not and list beneficiary distribution of profit and additional stipulations if any. This should be your first step before listing a trust property for sale.

You will want to hire a professional real estate agent to sell the trust property as this will help ensure that you made every effort to sell the property at market value for the interest of the beneficiaries. If the trustee sells the property carelessly for less then market value the beneficiaries can have recourse for underselling an asset that they have financial interest in.